Rick Scott Spotlight

The first in our Spotlight series.

Hello Stock Watchers! In the interest of avoiding packing in too much information in our biweekly updates, we’ve decided to release spotlights on key politicians. These will address individual congresspeople and their transactions in greater detail than in our normal updates. These pieces will be written by visiting contributors, so any feedback on who and what you want to see covered next is welcome and appreciated!

Senators have reported 109 trades in the $501,000-$1,000,000 bracket from January 2019 and April 2022. Of these 109 large trades, 80 were reported by Senator Scott’s spouse, and every single one was a municipal security trade.

Municipal securities are bonds issued by states, cities, counties and other governmental entities to raise money for public goods and services like roads and bridges, schools, and recreation facilities.

As of July 2022, there are about 400 municipal security trades reported by congressional members, and Rick Scott accounts for 173 of them. With Senator Scott accounting for such a high percentage of this category of exchange, especially at the highest bracket amounts, we must ask what exactly is Scott investing in, and what are his motivations?

With a fine mix of general, revenue, and utility bonds, Senator Scott invests mainly in these areas: Universities, medical centers, sanitation services, transportation services like port authorities and airports, and general obligation bonds for county seats in many different states. Scott’s municipal security holdings are located in a diverse array of states from all corners of the United States: Michigan, North Carolina, California, New York, Massachusetts, Ohio, and of course Florida to name a few.

So what, if anything, does a Senator from Florida have to do with municipal works projects across the country, and why is he trading at such a high volume?

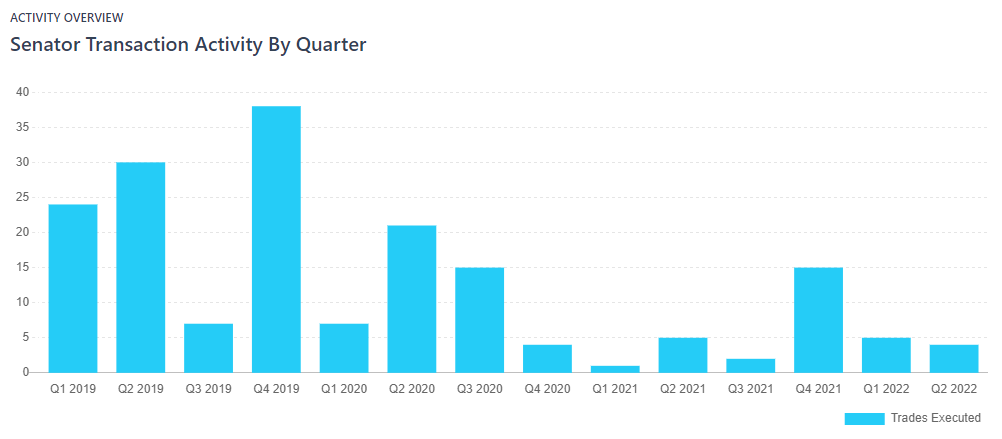

Scott’s municipal security spending spree began in 2019, slowed a bit in 2021, and continued in 2022. It is not uncommon for political figures to invest in revenue bonds in highly contested states or counties to signal trust and transparency. In 2019 alone the Senator had 58 trades of $500,001 and higher for municipal security bonds, in the divisive election year of 2020 he had 23. It slowed significantly in 2021, with only 8 the entire year, and with 2022 being half way over, he is already at 6.

As Florida is positioning itself as a center of conservative politics, a foil to the progressive stronghold of California, we may be seeing an example of a conservative Floridian leader sharing their success with swing states through monetary investment in public services. With California producing many national political players throughout the last few years including Vice President Kamala Harris, maybe this is an example of Flordian politicians expanding to a national stage. With two major 2024 Republican Presidential frontrunners, former president Trump and governor Ron DeSantis, there is no telling Florida is positioning itself to be the new center of United States conservative politics, and there is no doubt that Senator Scott is taking this into consideration when deciding how to invest his immense wealth.

With the 2020 election having multiple highly contested counties, this could be the answer. But how then do you explain his investment in states like California, New York, and Massachusetts?

Because blue states typically have more concentrated populations of people in their dense, sprawling cities, millions more in tax revenue flows through the governing bodies. This means there is more tax revenue available to fund public works projects on a larger scale and faster timeline than rural, less populous states, where their tax revenue makes it difficult to pay for every proposed major project.

In high uncertainty market periods like what the global economy has been under since 2020, the ultra-wealthy (including our representatives) tend to choose safety over high-risk high-return investments, and municipal bonds are a traditionally safe investment. In addition, most municipal bonds are tax exempt so large sums of money invested will generate tax-free interest over the time-span of the bond, with some expiring in over 20 years. As municipal bonds tend to have a high return, and are relatively safe, and there is a greater opportunity for municipal projects in blue states because of their dependably large population, Senator Scott could simply be making a smart, safe investment in blue states.

While we will never know any Senator’s precise reasoning behind their investments, we can use data collected to speculate. Our Senate Stock Watcher team will be watching Scott’s next moves closely, and will be keeping you updated on the rest of our congressional leaders’ exchanges in future spotlight updates!