July 1st-18th Update

Blog Post #4

Hello everyone!

Welcome to our bi-weekly written update, where we share the latest security transactions reported by US House and Senate representatives!

All of our data is pulled from Senate Stock Watcher and House Stock Watcher. And check out our podcast for further discussion!

Quick plug for our awesome Rick Scott Spotlight written by contributor Brennan Doyle! Listen to this week’s podcast for Brennan sharing further insights on Senator Scott’s municipal security trades and its possible political implications.

Without further ado, let’s get to our roundup!

Between July 1st and July 18th, Congresspeople disclosed a total of 172 transactions, consisting of 80 purchases, 61 full sales, 31 partial sales, and 0 exchanges.

The total amount traded was $7,141,172, consisting of $3,465,080 in purchases, $2,165,061 in full sales, and $1,511,031 in partial sales.

Senate Disclosures

Democrat Thomas Carper of Delaware’s spouse reported two transactions from June. They reported a full sale of Office Property Income Trust (OPI), a corporate bond worth between 1,000 and 15,000 dollars. They also reported a purchase of a Broadcom corporate bond of between 15,000 and 50,000 dollars.

Republican Thomas Tuberville of Alabama reported 27 transactions from June. Notable transactions include: One purchase and one full sale of 250,000-500,000 each of Qualcomm stock, Multiple 100,000-250,000 dollar transactions include purchases of United States Steel Corporation Common Stock, Paypal Holdings Inc, and sales of Common Copper Corporation. Other stock transactions include NVIDIA, Intel, Barrick Gold Corporation, and Stratasys Ltd.

Tennessee Republican Bill Hagerty reported four 100,000 - 250,000 dollar purchases for each of his four children’s trust funds. All four purchases were of Hill Partners Inc, a commercial real estate company that specializes in open-air shopping centers.

Republican Lindsay Graham of South Carolina reported three transactions from June. He purchased 16,000-65,000 dollars in “iShares iBonds Dec 2023 Term Corporate ETF” and sold a “Vanguard Short-Term Inflation-Protected Securities” for between 15,000 and 50,000 dollars.

Republican Dan Sullivan of Arkansas disclosed a full sale of RPM International stock of between 15,000-50,000 dollars.

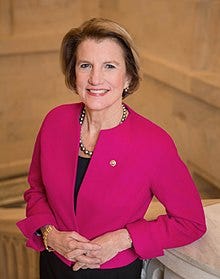

Republican Shelley Moore Capito of West Virginia disclosed 9 transactions from June. She disclosed one purchase of CMS Energy Corporation Common Stock of between 1,000-15,000 dollars. She disclosed 7 sales of between 1,000-15,000 dollars of Ford, Microsoft, Coca-Cola, Bristol-Myers Squibb, 3M Company, and International Business Machines Corporate stock, and one sale of Intel Corporation Common Stock for between 15,000-50,000 dollars.

House Disclosures

California Democrat Alan Lowenthal reported a full sale of Uber stock of between 1,000 and 15,000 dollars.

Democrat Cindy Axne of Iowa reported a 1,000 - 15,000 dollar full sale of Bellring Brands stock, a nutrition delivery company.

Democrat Debbie Wasserman Schultz of Florida reported two purchases of between 2,000 and 30,000 dollars total of Alamos Gold Inc Class A Common Shares.

Democrat Donald Beyer of Virginia reported a 15,000 - 50,000 dollar full sale of a called government security of Farmington, New Mexico Pollution VAR.

Oregon Democrat Earl Blumenauer reported 4 transactions this week from his spouse’s retirement portfolio. He reported 2 purchases; a 1,000 - 15,000 purchase of Warner Bros, Discovery stock and a 15,000-50,000 dollar purchase of Sanofi - American Depositary Shares. He also reported 2 sales of between 2,000-30,000 dollars in IMAX stock.

North Carolina Democrat Kathy Manning reported 18 sales and ONE purchase from June. Her reported full and partial stock sales total between 319,000 and 910,000 dollars and include notable companies like Adobe, Blackstone, Chipotle, Netflix, Nvidia, and Snap Inc, and Visa. She made a single purchase of 250,000 - 500,000 dollars of Wonder Media Network private stock, a female-founded audio-first media company that “uses stories to inspire action, to promote equality and justice, and to introduce empathy into politics, business, and culture.”

Democrat Kurt Schrader of Oregon reported 3 transactions from June: He reported a purchase of Dollar General stock of between 1,000-15,000 dollars. He also reported two sales of Hilton Worldwide Holdings and Old Westbury Municipal Bond Fund of between 16,000 and 65,000 dollars.

Republican Virginia Foxx of North Carolina reported 25 transactions from the month of June. She reported 13 purchases of between 139,000 and 435,000 dollars of Capital One, National Health Investors Inc, and UBS Bank stocks to name a few. She also reported 12 full sales of between 866,000 and 2,115,00 dollars of Altaria Group, AT&T, Clearway Energy, Enterprise Products Partners LP, Exxon Mobil, Green Plains Partners LP, Manulife FInancial Corporation, Plains All American Pipeline LP, Rio Tinto Plc, Schwab S&P 500, and TotalEnergies SE stock.

Republican Pete Sessions of Texas reported two purchases of between 1,000-15,000 dollars each, of DigitalBridge Group and NVIDIA stocks.

Democrat James Langevin of Rhode Island disclosed 15 transactions from June. His largest disclosures were three 50,000-100,000 dollar purchases of AirBNB and Block Inc stock and a 50,000-100,000 sale of AirBNB. He also reported trades of Generac, Meta, and Doordash stocks.

Texas Democrat Lloyd Doggett disclosed four purchases of 1,000-15,000 dollars of International Business Machines Corporation, Home Depot, Johnson & Johnson, and PPG Industries Inc stocks.

California Democrat Brad Sherman disclosed two US Treasury Note purchases of $15,001 - $50,000 dollars and $250,001 - $500,000 dollars each.

California Democrat Zoe Lofgren reported a 1,000-15,000 dollar purchase of Ally Financial Inc stock.

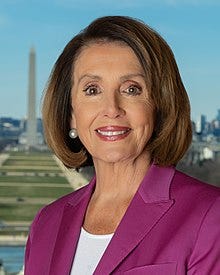

And finally, California Democrat Nancy Pelosi reported 3 large transactions from June 17th-21st. She sold 10k shares of Visa, Inc for between 1,000,001 - 5,000,000 dollars. She exercised 200 CALL options of 20 thousand shares of NVIDIA Corporation at a 100 dollar expiry, resulting in a purchase of between 1,000,000-5,000,000 dollars. She exercised 50 CALL options in Apple INC with a $100 expiry, resulting in a sale of between 100,000-250,000 dollars.

That’s all we have for you this week! Listen to our podcast here on Substack and wherever else you get your podcasts, check out our Subreddit, follow us on Twitter, and contribute transcriptions here!

HUGE THANKS to Tim and the amazing people transcribing the hand-written House disclosures that make all of this possible.

And thank you all so much for your continued patience and support!